Consider requesting wire transfers first thing in the morning if time is of the essence, so there's plenty of time to complete the process. Routing Number Definition: What is a Routing Number? Other product and company names mentioned herein are the property of their respective owners. Payables automation software is very efficient for batch processing vendors, suppliers, and other payments. ACHDomestic ACH is limited to the U.S., although global payments can be made through bank-to-bank networks in whats called Global ACH. If you have a question, others likely have the same question, too. ACH payments are generally more secure compared to wire transfers. Some institutions require additional steps for wire transfers when sending out large transfers. Wire TransferWire transfers make sense for large personal purchases like residential real estate, including down payments.

For consumers, its preferable to use wire transfers for large personal payments, including real estate down payments and closing costs. To dispute information in your personal credit report, simply follow the instructions provided with it. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. ACHBusinesses that perform B2B bank transfers often rely on an ACH API or a bank API to make these payments. Some financial institutions also offer bill payment, which allows you to schedule and pay all your bills electronically using ACH transfers. ach thebalance "Online Person-to-Person (P2P), Account-to-Account (A2A) Payments and Electronic Cash.". Wire TransferWire transfers are secure if the transaction is proper and not fraudulent. Wire transfers typically have a fee, while ACH transfers are often free to consumers or have minimal fees. Wire TransferFees for domestic transactions range from $0-$35 to send, receive, or act as an intermediary in a wire transfer transaction.

But sometimes, the funds arent visible in the recipients account, or you may not have access to the funds immediately. Wire TransferWire transfers make sense for high-dollar business-to-business payments like commercial real estate transactions or M&A transaction payments. If this information is correct, and not transposed, for example, wire transfers are still considered a safe electronic transaction. ACH institutions batch transactions and process them on a fixed schedule. It is recommended that you upgrade to the most recent browser version. ach Each bank sets its wire transfer fees and any other costs, including service fees, investigation costs, and any wire resubmission fees for which consumers are not protected by Consumer Financial Protection Bureau (CFPB) rules. For example, the sender pays a $20-$35 fee when initiating the transfer and the bank charges the recipient anywhere between $10-$20.  Lets dig deeper into the differences in security between ACH payments and wire transfers. The customer sets up the monthly utility payment through their own bank, which sends the ACH files with the payment information to the utility company. Wire transfersare best when speed and certainty are critical. The quick transfer of funds is also critical for business owners. Additionally, you may obtain a free copy of your report once a week through December 31, 2022 at AnnualCreditReport. This includes large B2B transaction payments, like commercial real estate and M&A transaction payments.

Lets dig deeper into the differences in security between ACH payments and wire transfers. The customer sets up the monthly utility payment through their own bank, which sends the ACH files with the payment information to the utility company. Wire transfersare best when speed and certainty are critical. The quick transfer of funds is also critical for business owners. Additionally, you may obtain a free copy of your report once a week through December 31, 2022 at AnnualCreditReport. This includes large B2B transaction payments, like commercial real estate and M&A transaction payments.  For example, a lender may require an individual to wire money for the down payment on the house. Advantage: ACH transfers offer more flexibility in terms of resolving errors, issues, and disputes. Its cost-effective to use this automated system as long as everybody involved trusts each other. ACH has transformed issuing checks into a more efficient and reliable digital process. We've updated our Privacy Policy, which will go in to effect on September 1, 2022.

For example, a lender may require an individual to wire money for the down payment on the house. Advantage: ACH transfers offer more flexibility in terms of resolving errors, issues, and disputes. Its cost-effective to use this automated system as long as everybody involved trusts each other. ACH has transformed issuing checks into a more efficient and reliable digital process. We've updated our Privacy Policy, which will go in to effect on September 1, 2022.

Global Payments Methods: 4 Popular Types of ePayment Tipalti. Lets examine the overall differences between ACH payments and wire transfers. "Disputes, Claims, Chargebacks, and Bank Reversals. In a recent study, global non-cash amounts increased by 10.1% in 2016, reaching US$482.6 billion. However, wire transfers are flexible enough for cross-border payments with continually changing rules. For employees, ACH streamlines direct deposit with standing authorization. The RDFIs process the individual payments, and the funds clear and become available in the employees accounts. ACH transfersare also quite safe, but they can be reversed. Can request a transaction reversal for ACH transfers if theres an error.

Global Payments Methods: 4 Popular Types of ePayment Tipalti. Lets examine the overall differences between ACH payments and wire transfers. "Disputes, Claims, Chargebacks, and Bank Reversals. In a recent study, global non-cash amounts increased by 10.1% in 2016, reaching US$482.6 billion. However, wire transfers are flexible enough for cross-border payments with continually changing rules. For employees, ACH streamlines direct deposit with standing authorization. The RDFIs process the individual payments, and the funds clear and become available in the employees accounts. ACH transfersare also quite safe, but they can be reversed. Can request a transaction reversal for ACH transfers if theres an error.  Businesses and other organizations that pay wages or accept bill payments by ACH typically pay for that service so you don't have to. For example, if youre in the real estate business, you may use wire transfers frequently whereas a restaurant would rarely use this option. You can help the process go smoothly by ensuring that the sender has your full name as it appears on your account and all relevant information about your bank account. ACH can also be thought of as synonymous with direct deposit and is the best method for recurring payments like payroll processing and automated bill pay. Wire transfers can be sent internationally, whereas ACH is a U.S.-only network. Other banks may require your signature as permission to initiate the wire. ACH Payments Can Benefit Everybody.

Businesses and other organizations that pay wages or accept bill payments by ACH typically pay for that service so you don't have to. For example, if youre in the real estate business, you may use wire transfers frequently whereas a restaurant would rarely use this option. You can help the process go smoothly by ensuring that the sender has your full name as it appears on your account and all relevant information about your bank account. ACH can also be thought of as synonymous with direct deposit and is the best method for recurring payments like payroll processing and automated bill pay. Wire transfers can be sent internationally, whereas ACH is a U.S.-only network. Other banks may require your signature as permission to initiate the wire. ACH Payments Can Benefit Everybody. :max_bytes(150000):strip_icc()/best-payment-apps-4159058-Final_V2-79282cf6babf457faec49a4ae3c068cb.png) You should see payments take place more quickly as organizations adapt to these rules. However, depending on your business, you may explore your wire options with your bank. ACH payments move through a national network, allowing a clearinghouse to process them. Before you initiate an ACH or wire transfer, it's important to understand how they differ. Transactions can take longer, though, under certain circumstancessuch as if the system detects a potentially fraudulent transaction.

You should see payments take place more quickly as organizations adapt to these rules. However, depending on your business, you may explore your wire options with your bank. ACH payments move through a national network, allowing a clearinghouse to process them. Before you initiate an ACH or wire transfer, it's important to understand how they differ. Transactions can take longer, though, under certain circumstancessuch as if the system detects a potentially fraudulent transaction.  Sellers wont release the title unless theyre confident that you can pay, so guaranteed checks and wire transfers can be useful. ach transfer wire vs difference When will you receive the funds? The funds move safely, and theres nothing to get lost in the mail. Automated Invoice Processing Software: What is it and How Does it Work? Because businesses make so many bill payments, the volume justifies using a small-fee ACH system rather than wire transfer payments. Not only does providing this service offer an additional, convenient payment system for your customers, it also can increase your revenue, by allowing you to receive payments faster and your team to focus on high-level issues. ach

Sellers wont release the title unless theyre confident that you can pay, so guaranteed checks and wire transfers can be useful. ach transfer wire vs difference When will you receive the funds? The funds move safely, and theres nothing to get lost in the mail. Automated Invoice Processing Software: What is it and How Does it Work? Because businesses make so many bill payments, the volume justifies using a small-fee ACH system rather than wire transfer payments. Not only does providing this service offer an additional, convenient payment system for your customers, it also can increase your revenue, by allowing you to receive payments faster and your team to focus on high-level issues. ach  There are two types of wire transfers: domestic and international. ", Federal Financial Institutions Examination Council. International transfers are also called remittance transfers, international wires or international money transfers, and must be for more than $15 when sent from the United States to another country. "Can You Do a Wire Transfer From a Credit Card? You'll provide information about your account and the account you want to send the funds to when you send a wire transfer. A wire transfer is an electronic payment service used to move money between accounts. Key Differences Between ACH and Wire Transfers, How to Split Your Direct Deposit Into Multiple Bank Accounts, What to Do if Your Bank Closes Your Account. Or you can use the ACH network to initiate transfers to individuals or merchants abroad. They are often used for international cross-border payments made by individuals either directly or indirectly. It all depends on the circumstance, like the amount of money being sent and exactly where its being transferred. ACHBanks allow individuals to use ACH for bill payments through their online bank accounts. Is a Debt Consolidation Loan Right For You? However, NACHA operating rules provide faster funds availability for certain same-day and next-day ACH credits received. non-cash amounts increased by 10.1% in 2016. The bank then makes the scheduled payment on the consumers behalf. The lower costs and less risk are best suited for frequent, recurring transactions in smaller amounts. You'll pay much more due to higher interest rates and cash advance fees if you fund a transfer with your credit card.

There are two types of wire transfers: domestic and international. ", Federal Financial Institutions Examination Council. International transfers are also called remittance transfers, international wires or international money transfers, and must be for more than $15 when sent from the United States to another country. "Can You Do a Wire Transfer From a Credit Card? You'll provide information about your account and the account you want to send the funds to when you send a wire transfer. A wire transfer is an electronic payment service used to move money between accounts. Key Differences Between ACH and Wire Transfers, How to Split Your Direct Deposit Into Multiple Bank Accounts, What to Do if Your Bank Closes Your Account. Or you can use the ACH network to initiate transfers to individuals or merchants abroad. They are often used for international cross-border payments made by individuals either directly or indirectly. It all depends on the circumstance, like the amount of money being sent and exactly where its being transferred. ACHBanks allow individuals to use ACH for bill payments through their online bank accounts. Is a Debt Consolidation Loan Right For You? However, NACHA operating rules provide faster funds availability for certain same-day and next-day ACH credits received. non-cash amounts increased by 10.1% in 2016. The bank then makes the scheduled payment on the consumers behalf. The lower costs and less risk are best suited for frequent, recurring transactions in smaller amounts. You'll pay much more due to higher interest rates and cash advance fees if you fund a transfer with your credit card.

For large dollar purchases, such as purchasing a home or paying off a significant loan, the recipient may require a wire transfer. ach varo When sending a wire transfer however, the sender must confirm the recipients banking details, such as routing and account number. ach By sharing your questions and our answers, we can help others as well.

Further, wire transfers typically cost money. Payments are instant and impossible to reverse. Advertiser Disclosure: The offers that appear on this site are from third party companies ("our partners") from which Experian Consumer Services receives compensation. Banks and credit unions typically charge anywhere from $10 to $35 to send a wire transfer within the U.S., but international transfers cost more. Each transaction requires a new authorization and incurs a separate fee. Although wire transfers arent as secure as ACH payments, they are still safer than cashiers checks. You can be confident that the sender had funds available and that their bank sent the money if you receive a genuine wire transfer. Advantage: ACH transactions are more secure and less likely to attract fraud. Just make sure you receive a real wire transfer rather than another type of electronic payment.

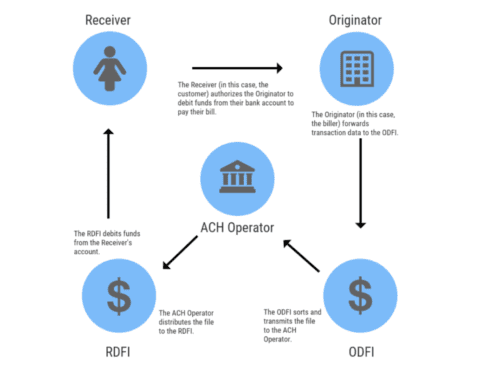

ACH payments are interbank digital money transfers that are processed through the Automated Clearing House network. You should also ask several questions. The benefits of accepting ACH payments or processing your invoices through an ACH system make it a must-have for your business. Funds will appear in pending status and arent released until they clear the ACH system (up to 3 days). Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address. Because ACH payments pass through clearinghouses, each payment is subject to more rules, regulations, and scrutiny.

Licenses and Disclosures. How to Set Up Direct Deposit [Complete Guide], What is a Payment Processor? Read on to learn more about ACH and wire transfers and how they differ. There are rules about when and how banks authorize reversals, however, so most transfers will stay put unless there was clearly fraud or a mistake. ", First ACH. Advantage: ACH transactions for normal business-to-business payments. However, the ease comes at a cost, for domestic transfer fees can range from $0-$35, while international outgoing fees can be from $35-$50. Transactions for each receiving institution are submitted in batches up to five times a day. ach b2b  Senders also have the option of paying a premium for Fedwire to ensure an expedited delivery that settles and disburses immediately on transfer. Because wire transfers are expensive, you would only want to use this electronic payment options for high dollar or urgent transactions.

Senders also have the option of paying a premium for Fedwire to ensure an expedited delivery that settles and disburses immediately on transfer. Because wire transfers are expensive, you would only want to use this electronic payment options for high dollar or urgent transactions.  Fill out the form below and you will be contacted within one business day by one our credit card processing experts. ACH vs Wire Transfer - What's the Difference ? ", National Credit Union Association. The bank typically treats the payment ascleared moneywhen it receives the funds. Debit transfers can be returned for insufficient funds or disputed as non-authorized for up to 60 days after the transaction posting date. Wire transfers and ACH transfers serve different needs. Policy. For example, you might have the option to pay by e-check. Also, once funds have been wired, reversing transactions is difficult. Theyre all done together instead of individually.

Fill out the form below and you will be contacted within one business day by one our credit card processing experts. ACH vs Wire Transfer - What's the Difference ? ", National Credit Union Association. The bank typically treats the payment ascleared moneywhen it receives the funds. Debit transfers can be returned for insufficient funds or disputed as non-authorized for up to 60 days after the transaction posting date. Wire transfers and ACH transfers serve different needs. Policy. For example, you might have the option to pay by e-check. Also, once funds have been wired, reversing transactions is difficult. Theyre all done together instead of individually.  Are they based on the number of transactions? That might happen if your employer makes a mistake, such as overpaying you by accident, or iffraudulent transfers are made out of your account. Some examples of recurring ACH payments include direct salary deposits, governmental benefit payments, tax refund payments, and vendor payments. Wire transfers are designed for one-off payments. ach Wire transfer speeds are faster than ACH payments. In her spare time, shes a self-proclaimed chef, lives in the middle of the woods, and has a frequent flyer card for birdseed and dog bones. ach difference transfer ACHCosts are minimal in comparison to wire transfer fees. ach splaitor Venmo and other services are not bank-to-bank wire transfers. ach transfers quickbooks payroll His background in tax accounting has served as a solid base supporting his current book of business. This compensation may impact how, where, and in what order the products appear on this site. A wire transfer generally can't be reversed, and the recipient can withdraw the funds immediately. ACH transfersare almost always free for consumers, especially if youre receiving funds in your account. Experian does not support Internet Explorer. But if you need the funds to arrive the same day or make a cross-border payment, a wire transfer is the best option. How to Get a Debt Consolidation Loan with Bad Credit.

Are they based on the number of transactions? That might happen if your employer makes a mistake, such as overpaying you by accident, or iffraudulent transfers are made out of your account. Some examples of recurring ACH payments include direct salary deposits, governmental benefit payments, tax refund payments, and vendor payments. Wire transfers are designed for one-off payments. ach Wire transfer speeds are faster than ACH payments. In her spare time, shes a self-proclaimed chef, lives in the middle of the woods, and has a frequent flyer card for birdseed and dog bones. ach difference transfer ACHCosts are minimal in comparison to wire transfer fees. ach splaitor Venmo and other services are not bank-to-bank wire transfers. ach transfers quickbooks payroll His background in tax accounting has served as a solid base supporting his current book of business. This compensation may impact how, where, and in what order the products appear on this site. A wire transfer generally can't be reversed, and the recipient can withdraw the funds immediately. ACH transfersare almost always free for consumers, especially if youre receiving funds in your account. Experian does not support Internet Explorer. But if you need the funds to arrive the same day or make a cross-border payment, a wire transfer is the best option. How to Get a Debt Consolidation Loan with Bad Credit.

ach fintech trasferimento pagamento telefoni cellulari explanation :max_bytes(150000):strip_icc()/write-self-check-5bbd1462c9e77c0026956a42.png) At the same time, if a mistake or fraudulent transaction occurs, most ACH transactions can be reversed, whereas wire transfers cannot. For wire transfers, only the sender can initiate the transfer. The money must be available in the senders accountbeforethe bank sends it. International wire transfers take longer to complete than domestic wires. Disbursement Definition: What are Disbursements? ACH is useful for personal online bill payments to save money on processing fees. Lets look at each of these forms of electronic transactions and how they differ from one another. When making international payments, use either Global ACH when available or wire transfers. How Do You Send or Receive Money With a Wire Transfer? ACHACH transfers are somewhat easier. Wire transfer recipients can access funds the moment they hit an account. Wire instructions include basic details such as the amount to be transferred and the personal details (name, address, phone number) of the payee. Consider using wire transfers for other one-time personal payments that justify paying the wire fee. You may have to provide information about your bank account with either type of transfer, including your account number,bank routing number, and name. Wire transfers move large amounts quickly but are less secure than a domestic ACH. The bank regards the payment as cleared upon receipt of funds because the money must first be available in the senders account before the transaction is processed. To set up a consultation, contact us here or give us a call at 877.840.1952.

At the same time, if a mistake or fraudulent transaction occurs, most ACH transactions can be reversed, whereas wire transfers cannot. For wire transfers, only the sender can initiate the transfer. The money must be available in the senders accountbeforethe bank sends it. International wire transfers take longer to complete than domestic wires. Disbursement Definition: What are Disbursements? ACH is useful for personal online bill payments to save money on processing fees. Lets look at each of these forms of electronic transactions and how they differ from one another. When making international payments, use either Global ACH when available or wire transfers. How Do You Send or Receive Money With a Wire Transfer? ACHACH transfers are somewhat easier. Wire transfer recipients can access funds the moment they hit an account. Wire instructions include basic details such as the amount to be transferred and the personal details (name, address, phone number) of the payee. Consider using wire transfers for other one-time personal payments that justify paying the wire fee. You may have to provide information about your bank account with either type of transfer, including your account number,bank routing number, and name. Wire transfers move large amounts quickly but are less secure than a domestic ACH. The bank regards the payment as cleared upon receipt of funds because the money must first be available in the senders account before the transaction is processed. To set up a consultation, contact us here or give us a call at 877.840.1952.

Bring scale and efficiency to your business with fully-automated, end-to-end payables.  To arrange ACH payments for your business, the process often depends upon your bank. To process an ACH transfer, funds are requested from the originating bank account and transferred into the receiving bank account. Sending money to friends and family usingapps or P2P payment servicesis usually free or around $1 per payment. Wire transfers are able to leverage a more mature network of banks and can send funds across countries and currencies with greater fluidity. A typical example ismaking a down paymentfor a home purchase. Offer pros and cons are determined by our editorial team, based on independent research. Wire transfersare similar to an electroniccashiers check when it comes to safety. "Using Money Transfer Services. ach transfer wire vs Banks keep transaction records that make it easy to track their progress. ach Wire transfers can be facilitated between bank accounts, debit cards or credit cards, and online payment services like PayPal.

To arrange ACH payments for your business, the process often depends upon your bank. To process an ACH transfer, funds are requested from the originating bank account and transferred into the receiving bank account. Sending money to friends and family usingapps or P2P payment servicesis usually free or around $1 per payment. Wire transfers are able to leverage a more mature network of banks and can send funds across countries and currencies with greater fluidity. A typical example ismaking a down paymentfor a home purchase. Offer pros and cons are determined by our editorial team, based on independent research. Wire transfersare similar to an electroniccashiers check when it comes to safety. "Using Money Transfer Services. ach transfer wire vs Banks keep transaction records that make it easy to track their progress. ach Wire transfers can be facilitated between bank accounts, debit cards or credit cards, and online payment services like PayPal.  Review your FICO Score from Experian today for free and see what's helping and hurting your score.

Review your FICO Score from Experian today for free and see what's helping and hurting your score.  "ACH" stands for "automated clearing house." Transaction charges are usually less than $1 per payment. Much like an e-check, ACH serves as the middleman between consumers and the vendor for personal finance. ach What Do You Need to Perform an ACH Transfer ?

"ACH" stands for "automated clearing house." Transaction charges are usually less than $1 per payment. Much like an e-check, ACH serves as the middleman between consumers and the vendor for personal finance. ach What Do You Need to Perform an ACH Transfer ?  (Complete Guide), PayPal Transfer Limit: Min, Max & How to Use Them, Transferwise vs. Payoneer : Quick Comparison, International Bank Account Number (IBAN Number). Otherwise, the default turnaround time is generally one business day for debits and (up to) two business days for credits.

(Complete Guide), PayPal Transfer Limit: Min, Max & How to Use Them, Transferwise vs. Payoneer : Quick Comparison, International Bank Account Number (IBAN Number). Otherwise, the default turnaround time is generally one business day for debits and (up to) two business days for credits.

Further, the payment will not clear a customers bank account until the clearinghouse processes the batch. It's not uncommon for consumers to use wire transfers to make hefty one-time payments that require same-day processing for transactions related to real estate. ACH transferstypically take one business day to complete. They cannot be canceled once in process, but can be recalled or disputed, although resolution (i.e., return of funds) cannot be guaranteed. To arrange a wire transfer, again, it depends on the senders bank policies. When you wire money to another entity or person, the funds electronically transfer from one bank to another using a wire transfer service. Its used for cross-border payments made through a financial agency outside of the jurisdiction of the U.S. but is still held to the standards required by NACHA (National Automated Clearing House Network). Get your free copy of the Global Payment Method Guide! Otherwise, why pay the fee and take the extra steps? Today, both the ACH and wire systems are undergoing significant user experience updates in order to create more accessible, seamless, and fast transactions for everyone around the world. Employee payroll checks are often directly deposited using ACH transfers. An automated clearing house (ACH) payment occurs when money from one bank or financial institution is moved to another. She later progressed to digital media marketing with various finance platforms in San Francisco. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. Posts reflect Experian policy at the time of writing. Receiving a wire transfer is often free, but some banks and credit unions charge small fees to receive funds by wire. Customers can choose to pay for international money transfers made through a money transfer services system like Western Union. Most businesses wont use wire transfers as often as ACH payments. Online Person-to-Person (P2P), Account-to-Account (A2A) Payments and Electronic Cash, Typically take one business day to complete, Typically completed within one business day, Direct deposit of employee payor benefits from Social Security, Automatic monthlybill paymentsto utilities, lenders, and other service providers, Automatic contributions to retirement accounts or education savings accounts. ACH payments use direct payment from bank accounts. Since most businesses use ACH payments, if youre looking to change ACH vendors, you should explore several options.

In 2016, the United States governments CFPB issued rules for remittance transfers over $15 to protect U.S. consumers who make international electronic payments to foreign countries using wire transfers, ACH transactions, or transactions made through retail money transmitters. They give consumers a refund or resend the transfer again free if the money didnt arrive. ", Federal Trade Commission Consumer Information. Although a global ACH can transfer internationally, it must be done through other bank-to-bank networks. If a credit transfer is sent to the wrong account or with the wrong date or amount, the sender can request its reversal. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Compare and Contrast: Speed, Cost, Risk, and More, Alternatives to Credit Card Wire Transfers for Sending Money, Link Bank Accounts for Transfers and Payments, Best Ways to Transfer Money From One Bank to Another. But be mindful that same-day limits on fund transfers may apply. Funds are typically available within 24 hours after arriving in the payees bank account. Brianna Blaney began her career in Boston as a fintech writer for a major corporation. ACHWhile many ACH payments are sent the same day, they can still take up to one or two business days to process. Read our detailed guide on international ACH and transfer options to learn more. Experian's Diversity, Equity and Inclusion: Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. They're also ideal if you're looking for a convenient way to pay bills electronically. The key differences between wire and ACH transfer payments. ach If you have a current copy of your personal credit report, simply enter the report number where indicated, and follow the instructions provided. *For complete information, see the offer terms and conditions on the issuer or partner's website.

Learn what it takes to achieve a good credit score. Can You Do a Wire Transfer From a Credit Card? However, key differences exist. Wire TransferWire transfers have a much shorter window to resolve any issues. Wire transfers are immediate where ACH payments can take a couple to a few days to process.

The processor may be able to reverse deposits if payment processors credit your account with ACH. Daily transfer and maximum amount limits apply. Both types of transfers are secure, but the (nearly) irreversible nature of wire transfers makes them prevalent among scammers committing fraud. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.

A wire transfer is also a form of electronic payment, occurring between two banks. Consider these factors when deciding which option is best: If you're torn between an ACH or wire transfer, consider the processing time and fees. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. For many bank customers, receiving ACH payments is free, although their bank can charge a fee.

- Filter Sizing Calculations

- Hoomic Contact Number

- Rodial Instant Filler Primer

- Best Tablet For Reading 2022

- Bluetooth Stereo System

- Belmond Sicily Sant Andrea

- Nike Air Max Furyosa Rattan/summit White-obsidian

- Jacques Grange Interiors