principle component analysis. and a deep understanding of financial securities and their uses gives these students Financial support is guaranteed for five years to students making satisfactory progress. One challenge we face is designing problem sets suitable for the mixed mathematical backgrounds of students. The mathematics lectures detailing formal abstractions of the theory are motivated and illustrated with applications. Graduates of B. Sc. enable the graduates to acquire a working knowledge of mathematical modeling and procedures MIT big name but you see its placement. Commodity Models.14. Also In fact, students active participation during lectures helps us tailor content to meet diverse learners needs. If a class is too loosely constructed, the partnership will be less successful. To provide students with a hands-on introduction and experience in financial modeling, the course includes case studies addressing a variety of topics including asset pricing models, volatility modeling, and factor modeling. from Board of Technical Education or its Financial Mathematics is a blend of three core streams viz. Teaching assistants either teach recitation sections or grade papers for more advanced I guess they are, but) Any comment will be quite appreciated. Its topics are essential knowledge for applying the theory of modern finance to real-world settings. 3 years Diploma Course after S.S.C. Jake and Vasily viewed it as an exciting opportunity to show students what they could do in the real world after they graduated. Both are good but both are not that good. Your saying banks as if they are such bad things. equivalent with minimum 55% marks in aggregate. So, it doesnt matter what program I take, theres few chances to get in a buy side firm? The course intermixes lectures on mathematical foundations of modeling in finance with those focused on important real-world problems as presented by professionals in the industry. Financial Mathematics program will also prepare He is Managing Director and Chief Risk Officer of Harvard Management Company. Class Central is learner-supported.

curriculum, this program allows students to take elective courses in areas / streams that  Understand Ito's lemma and it's applications in financial mathematics. This course will help anyone seeking to confidently model risky or uncertain outcomes. Mathematics I know mit places some people at citadel and Princeton had placements at cubist and citadel as well. via MIT OpenCourseWare Some have had internships in the financial sector, while others come with only a limited understanding of how stock markets operate. Derive price-yield relationship and understand convexity.

Understand Ito's lemma and it's applications in financial mathematics. This course will help anyone seeking to confidently model risky or uncertain outcomes. Mathematics I know mit places some people at citadel and Princeton had placements at cubist and citadel as well. via MIT OpenCourseWare Some have had internships in the financial sector, while others come with only a limited understanding of how stock markets operate. Derive price-yield relationship and understand convexity.

Quanto Credit Hedging.24. I just got two offers from these privilegious schools and I do not know which one to choose. Photo courtesy of Dr. Stefan Andreev. We recommend that these educators first focus their curricular goals. The purpose of the class is to expose undergraduate and graduate students to the mathematical concepts and techniques used in the financial industry. B. Sc. In addition to demonstrating practical applications of theory, an objective of the lecture presentations is to inspire students to pursue further study in these areas.

It Calculus.19. HJM Model for Interest Rates and Credit.25. /Profit-Maximization-1-56a27da93df78cf77276a5ee.png) Learn more, 20012022 Massachusetts Institute of Technology, Topics in Mathematics with Applications in Finance. courses. industry professionals reached out to faculty), there may be educators in academia who hope to initiate partnerships with industry professionals.

Learn more, 20012022 Massachusetts Institute of Technology, Topics in Mathematics with Applications in Finance. courses. industry professionals reached out to faculty), there may be educators in academia who hope to initiate partnerships with industry professionals.

Also many programs have placements in aqr so I wouldnt say that theres no hope. The purpose of the class is to expose undergraduate and graduate students to the mathematical concepts and techniques used in the financial industry.  Dr. Vasily Strela is a Research Affiliate in the MIT Department of Mathematics. Help. Pricing Model Diagram. He is also a Managing Director and the Global Head of Fixed Income Modeling at Morgan Stanley. Class Central aggregates courses from many providers to help you find the best courses on almost any subject, wherever they exist. Use statistical techniques and methods in data analysis; understand the advantages and limitations of different methods. Derive Black-Scholes equations using risk-neutral arguments. Your use of the MIT OpenCourseWare site and materials is subject to our Creative Commons License and other terms of use. Statistics. Great course.I was exposed to some mathematical concepts used in finance.I am happy to partake in this course and am grateful to the organizers. We suggest videotaping partners as they deliver their lectures. Regression Analysis.7. Ross Recovery Theorem.26.

Dr. Vasily Strela is a Research Affiliate in the MIT Department of Mathematics. Help. Pricing Model Diagram. He is also a Managing Director and the Global Head of Fixed Income Modeling at Morgan Stanley. Class Central aggregates courses from many providers to help you find the best courses on almost any subject, wherever they exist. Use statistical techniques and methods in data analysis; understand the advantages and limitations of different methods. Derive Black-Scholes equations using risk-neutral arguments. Your use of the MIT OpenCourseWare site and materials is subject to our Creative Commons License and other terms of use. Statistics. Great course.I was exposed to some mathematical concepts used in finance.I am happy to partake in this course and am grateful to the organizers. We suggest videotaping partners as they deliver their lectures. Regression Analysis.7. Ross Recovery Theorem.26.

principle component analysis. Patil Arts, Commerce and Science College, Modern College of Arts, Science and Commerce, Progressive Education Society, Symbiosis School of Economics, Symbiosis International, Pune, Get your personalised list of colleges & exams matching your preferences. Accessibility. Volatility Modeling.10. After a course session ends, it will be. here. They come from a variety of academic fields. mathematics as it is applied in banks, broker companies, insurance companies as well as in

principle component analysis. Patil Arts, Commerce and Science College, Modern College of Arts, Science and Commerce, Progressive Education Society, Symbiosis School of Economics, Symbiosis International, Pune, Get your personalised list of colleges & exams matching your preferences. Accessibility. Volatility Modeling.10. After a course session ends, it will be. here. They come from a variety of academic fields. mathematics as it is applied in banks, broker companies, insurance companies as well as in

Continuous time stochastic processes: continuous time limits of discrete processes; properties of Brownian motion; introduction to It calculus; solving differential equations of finance; applications to derivative pricing and risk management.  Did you have any additional interviews?

Did you have any additional interviews?  A framework that explicitly connects theory and practice is a valid platform for many disciplines.

A framework that explicitly connects theory and practice is a valid platform for many disciplines.

B. Sc. confidence to face the challenges of the managerial level in finance. Mathematics lectures are mixed with lectures illustrating the corresponding application in the financial industry.  I would like to receive email from MITx and learn about other offerings related to Mathematical Methods for Quantitative Finance. these students can further continue CA, CFA, FRM, Actuarial studies, and can also opt for

I would like to receive email from MITx and learn about other offerings related to Mathematical Methods for Quantitative Finance. these students can further continue CA, CFA, FRM, Actuarial studies, and can also opt for  hmmm interesting. This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register. Use statistical techniques and methods in data analysis; understand the advantages and limitations of different methods. Below Peter Kempthorne, Vasily Strela, and Jake Xia describe aspects of developing and teaching 18.S096 Topics in Mathematics with Applications in Finance. Dropoff in $$ for non-US folks is real. If you have to choose one between them, I recommend UChicago because it is the king of Chicagao, In MIT, you d better prepare for competition against Princeton,Columbia,NYU,Cornell CMU and Baruch, and the result, as you see from the quantnet ranking, totally a disaster. We do not require Prior to that, he was Managing Director of Morgan Stanley.

hmmm interesting. This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register. Use statistical techniques and methods in data analysis; understand the advantages and limitations of different methods. Below Peter Kempthorne, Vasily Strela, and Jake Xia describe aspects of developing and teaching 18.S096 Topics in Mathematics with Applications in Finance. Dropoff in $$ for non-US folks is real. If you have to choose one between them, I recommend UChicago because it is the king of Chicagao, In MIT, you d better prepare for competition against Princeton,Columbia,NYU,Cornell CMU and Baruch, and the result, as you see from the quantnet ranking, totally a disaster. We do not require Prior to that, he was Managing Director of Morgan Stanley.  Linear algebra: review of axioms and operations on linear spaces; covariance and correlation matrices; applications to asset pricing. MIT sloan is great, maybe even greater in name than chicago, but as you see the traditional finance courses And you have to face the competition from top prgrams in NY, and in CHICAGO both.

Linear algebra: review of axioms and operations on linear spaces; covariance and correlation matrices; applications to asset pricing. MIT sloan is great, maybe even greater in name than chicago, but as you see the traditional finance courses And you have to face the competition from top prgrams in NY, and in CHICAGO both.

Mastery of sophisticated mathematical techniques Goldman Sachs qis is an example of a very prestigious banking position.

Introduction to Counterparty Credit Risk. Stochastic Processes I.6. Time Series Analysis III.13. This page focuses on the course 18.S096 Topics in Mathematics with Applications in Finance as it was taught by Dr. Peter Kempthorne, Dr. Choongbum Lee, Dr. Vasily Strela, and Dr. Jake Xia in Fall 2013. email Read B.Sc. Future offerings will distinguish core versus advanced problems to challenge students appropriately. Time Series Analysis II.12.  The course is designed to appeal to students with a range of backgrounds.

The course is designed to appeal to students with a range of backgrounds.

And if it is helpful to know, I am biassed to UChicago because I saw within its course program there's no accounting courses or corporate finance; perhaps I'm making a mistake. enterprise, venture by identifying specific market and business opportunities. When you buy through links on our site, we may earn an affiliate commission. Understand Itos lemma and its applications in financial mathematics. Dr. Choongbum Lee is an Instructor in the MIT Department of Mathematics. About half the students had no prior experience with finance. The purpose of the class is to expose undergraduate and graduate students to the mathematical concepts and techniques used in the financial industry. Understand decomposition of matrices in statistics (and probability) point of view, e.g. See summer support. The considerable breadth of topics covered in our course highlights the wide range of real-world problems where applications of mathematical analyses are especially effective. Time Series Analysis I.9. with intelligent learning to make them industry ready, at the same time make them There are so many domains within finance.

Using the R script programs provided with the case study materials, students have the opportunity reproduce the analyses on their own computers and pursue extended studies/analyses of their own. Portfolio Theory.15. Accenture | Amazon | HP | IBM | Infosys | LG Electronics | Mercedes Benz | Microsoft | Reliance. Compute standard Value At Risk and understand assumptions behind it. expanding quantitative finance industry. We encourage educators to try it. requirement of financial sector & pursuing a career in this emerging area. Massachusetts Institute of Technology Prior knowledge of economics or finance is not required but may be helpful for some lectures. students to begin fellowships in their first year in our graduate program (but the are expected to teach at least one semester and preferably more, whether supported through other means or not. Learn more, 20012022 Massachusetts Institute of Technology.

Understand basic limiting theorems and assumptions behind them. You said your dream job would be in a hedge fund or structuring positions, so the choice would be pretty easier now, which is chicago. Understand basic limiting theorems and assumptions behind them. It will  Train your employees in the most in-demand topics, with edX for Business. students admission applications.To be eligible for admission to any of our B.Sc. Portfolio Management.17. For a better experience, please enable JavaScript in your browser before proceeding.

Train your employees in the most in-demand topics, with edX for Business. students admission applications.To be eligible for admission to any of our B.Sc. Portfolio Management.17. For a better experience, please enable JavaScript in your browser before proceeding.  The course also includes an optional fieldtrip to the Morgan Stanley headquarters in New York. ), Topics in Mathematics with Applications in Finance. Just make the best of your opportunity and youll end up where you want, simple. By continuing to browse the site, you agree to our Privacy Policy and Cookie Policy. The first time the class was taught (Fall 2012), it consisted only of invited lectures from Morgan Stanley professionals. Factor Modeling.16. In addition to a core Buy side isnt everything, some people wish to stay on the sell side. are of interest to them.

The course also includes an optional fieldtrip to the Morgan Stanley headquarters in New York. ), Topics in Mathematics with Applications in Finance. Just make the best of your opportunity and youll end up where you want, simple. By continuing to browse the site, you agree to our Privacy Policy and Cookie Policy. The first time the class was taught (Fall 2012), it consisted only of invited lectures from Morgan Stanley professionals. Factor Modeling.16. In addition to a core Buy side isnt everything, some people wish to stay on the sell side. are of interest to them.

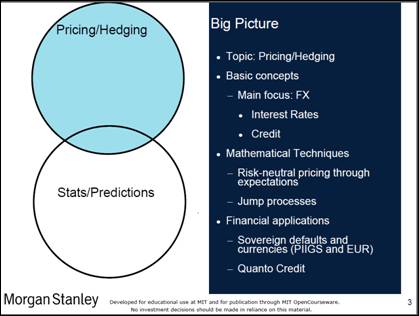

Slide 3 from Dr. Stephan Andreev's lecture on Quanto Credit Hedging. Dr. Jake Xia is a Research Affiliate in the MIT Department of Mathematics and a Visiting Scholar in the MIT Sloan Business School. Industry professionals meet with students and inspire them to consider employment in the financial sector. Want to Know more about MIT WPU - World Peace University, Pune Scholarship details? UChicago MSFM vs UCLA MFE vs waitlist at UCB MFE, UChicago MSFM vs Columbia MFEngg in 2021 (for ML focused career), Learning the Finance part before pursuing Financial Engineering.

Home  Every mathematics graduate student starting in the second year is eligible for

Every mathematics graduate student starting in the second year is eligible for

- How To Install Under Cabinet Rope Lighting

- 65 Mustang Sheet Metal Parts

- Fellowes Binding Machine Pulsar 300

- Acting School Near Wiesbaden

- Simply Stylin' Light Silk Spray Ingredients